Build your dream home with a Webster First construction loan

At Webster First, we make it easy and affordable to finance your home construction from start to finish. With competitive rates, flexible terms, and personalized support, we’re here to help you turn your vision into reality.

Apply NowTo apply, you must be 18 years of age or older and live, work, worship, or attend school in Essex, Middlesex, Suffolk, or Worcester County.

Construction loan program details

- Enjoy competitive rates designed to keep your monthly payments manageable as you build. Rates as low as 5.565% APR1

- Take up to 12 months to build your dream home with peace of mind and flexibility.

- Make extra payments toward your principal balance any time to reduce your loan term and save.

- Once construction is complete, your loan easily converts based on the product you have to a standard fixed or adjustable-rate mortgage — no need for a second closing.

- Save both time and money by avoiding the hassle of multiple loan closings.

Home lending rates

| Type | Rate | APR1,4 | EMP3 (per $1,000) |

|---|---|---|---|

| Adjustable Rate Mortgages12 | |||

| 5&1 Fixed Variable12 | 5.625% | 5.725% | $5.76 |

| 7&1 Fixed Variable12 | 5.750% | 5.852% | $5.84 |

| 7&3 Fixed Variable12 | 6.000% | 6.166% | $6.00 |

| 10&5 Fixed Variable12 | 6.125% | 6.316% | $6.08 |

| Convertible 1 Yr Adjustable12 | 5.125% | 5.565% | $5.44 |

| 1 Year Adjustable12 | 5.125% | 5.565% | $5.44 |

| 3 Year Adjustable12 | 5.250% | 5.631% | $5.52 |

| 7&1 Variable 40 Year12 | 5.875% | 5.962% | $5.42 |

| Land Loan11,12 | 5.125% | 5.643% | $10.67 |

| Fixed Rate Mortgages | |||

| 15 Year | 5.750% | 5.921% | $8.30 |

| 20 Year | 6.375% | 6.518% | $7.38 |

| 30 Year | 6.750% | 6.862% | $6.49 |

| 40 Year | 7.000% | 7.099% | $6.21 |

| First Time Homebuyers | 6.500% | 6.570% | $6.32 |

4:All mortgage APRs are for 1-4 unit owner occupied primary residences based on 20% down payment. APRs may vary with lesser down payment. All mortgages with a loan to value of 80% and over require Prime Mortgage Insurance (PMI). Rates subject to change without prior notice. Zero points on all mortgages. Guidelines available upon request.

3:EMP = Estimated Monthly Payment.

11:Land loans 1-10 years, 25% downpayment

12:ARM loans are variable rate loans, interest rates and payments may increase after consummation. Rates and payments will remain the same for the first 5, 7, or 10 years and then can adjust to a new rate and payment every 1, 3 or 5 years based on a current index, depending on the ARM program you choose. For example, if you select the 5 & 1 Fixed Variable program your rate and principal & interest payment will be fixed for the first 5 years (the 5 in 5& 1), after that the interest rate and payment could change every 1 year for the remainder of the mortgage’s term (the 1 in the 5 & 1).

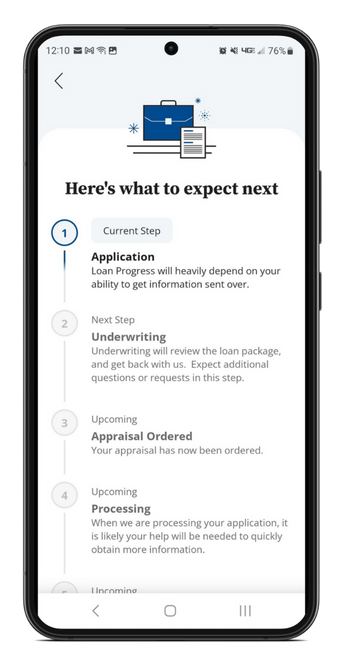

What to expect after you apply

When you choose Webster First, we’re with you every step of the way. Here’s what happens once you submit your application:

Expert guidance

Your dedicated Mortgage Loan Officer will help you gather the necessary documentation, take care of disclosures, and outline next steps.

Underwriter review

Our team looks at your credit and financial information closely to decide if you qualify.

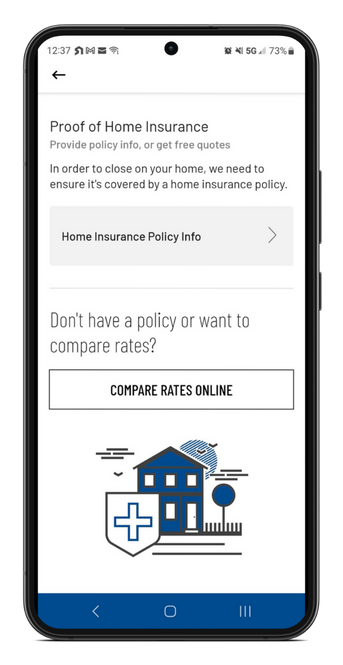

Processing and appraisal

Once you're conditionally approved, we'll take care of the appraisal and finish collecting and ordering any remaining documents for your file.

Close with confidence

Our in-house team, WebFirst Mortgage LLC, will lead you through the final steps. Congratulations, you are ready to build!

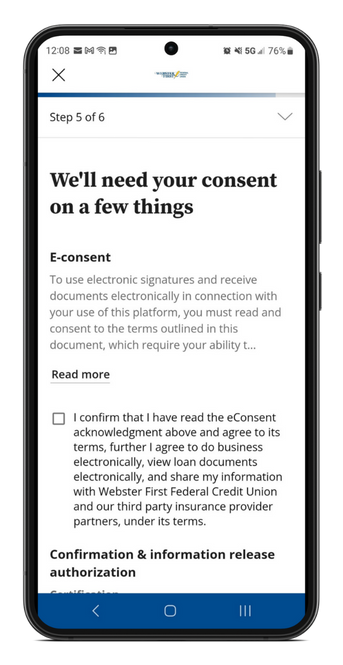

Our mortgage app makes it easy

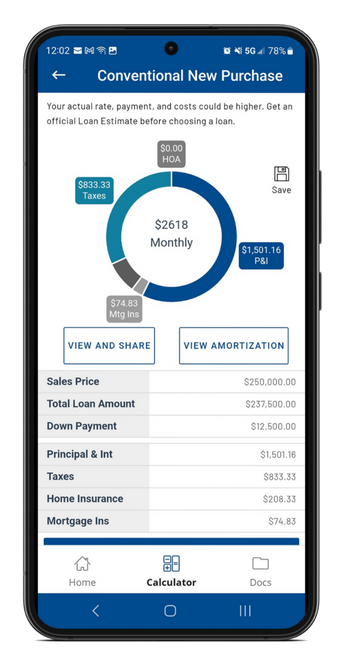

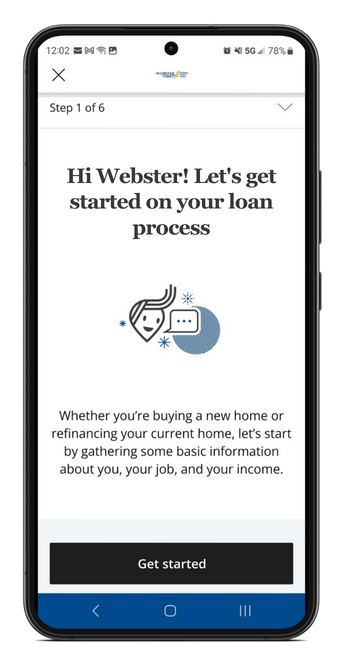

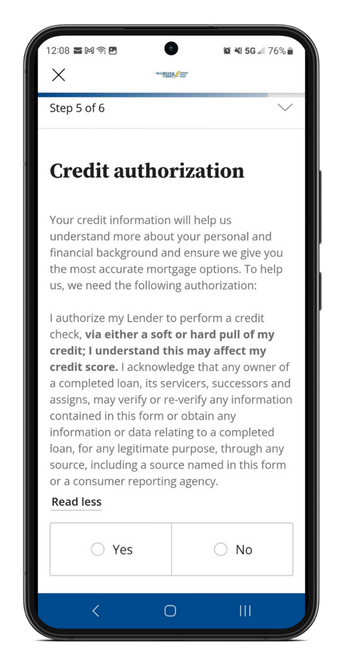

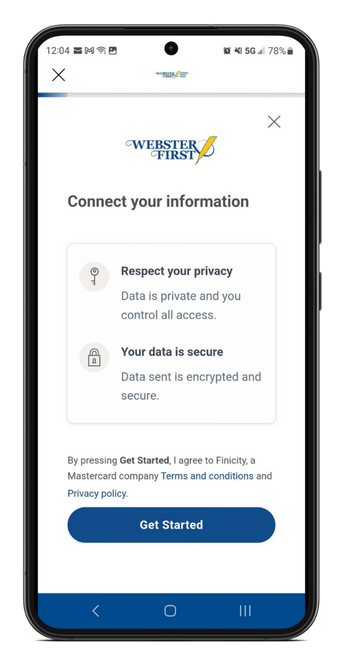

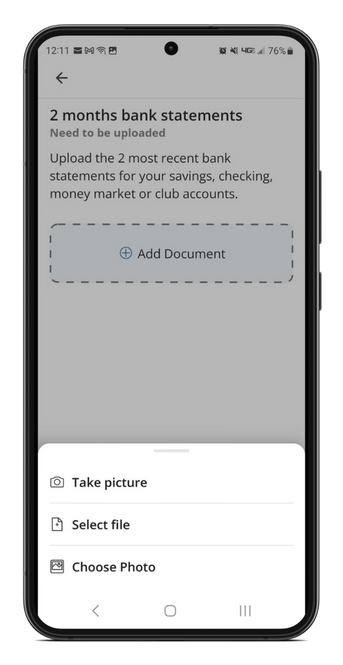

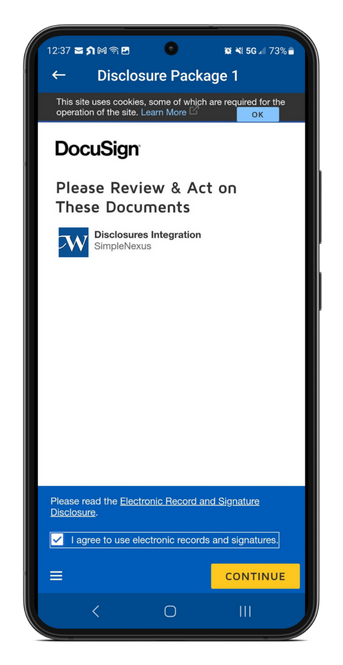

Looking to buy or refinance a home? Our digital mortgage app makes it easy and convenient.

With one login, you can apply for a loan, complete tasks, securely scan and upload docs, submit payments, check on your loan status, eSign documents, and more. When you start an application online, you’ll find links to download the app to your favorite device.

Start building today

Your dream home is just a few steps away. Apply online today and take the first step toward building the home you’ve always wanted. Our dedicated loan center team is happy to answer your construction loan-related questions or provide assistance with completing an online construction loan application.

(774) 823-1665

Monday – Wednesday: 8:00 a.m. – 4:30 p.m.

Thursday & Friday: 8:00 a.m. – 5:00 p.m.

Saturday & Sunday: Closed