Save money when rates are high with an adjustable rate mortgage (ARM loan)

Updated August 30, 2024 | Published April 24, 2023 by Angela Talbot | Reading Time: 3 minutes

-

Categories:

- Home Lending

- Saving & Budgeting

Throughout 2022 and into 2023, the Fed has been raising interest rates in an attempt to curb inflation. Consequently, these rate hikes have caused many banks and credit unions to follow suit and raise mortgage rates. Although a rate drop is expected later in 2024, experts can’t quite predict when.

If you’re looking for a mortgage in this high rate environment, you may be thinking that locking in a rate with a fixed rate mortgage is your best bet. After all, this would prevent the mortgage from increasing to even higher rates if the Fed continues raising them. However, this isn’t always the case. You could potentially earn a lower interest rate by choosing an adjustable rate mortgage (or ARM). Let’s break it down.

What is an adjustable rate mortgage (ARM loan)?

An adjustable rate mortgage is a loan that doesn’t have a locked interest rate. Rather, it has an interest rate that changes periodically based on the term you selected for your loan. Our adjustable rate mortgages come in a variety of terms such as 5 & 1, 7 & 1, 7 & 3, or 10 & 5. These terms are fixed variables, meaning that your interest rate will be fixed for the first portion of your loan’s life, and adjusted after that. The first number in the term indicates how many years the loan will have a fixed interest rate. The second number in the term indicates how often it will be adjusted after the fixed period is over.

Our most popular adjustable rate term is the 7 & 1. The rate is fixed for the first 7 years and adjusted once a year, every year after that. Not all of our ARMs are fixed variables. See our rate sheet for more terms.

Why should I choose an adjustable rate mortgage?

The appeal of the ARM when rates are high is that you could potentially enter a mortgage agreement at a lower rate than what is offered on a fixed rate mortgage, thus resulting in a lower monthly payment for you.* If you plan to move or refinance in less than ten years, you could avoid the adjustable period of the loan altogether. If the 5, 7, or 10 year fixed period ends and rates are lower, you may decide to stick with your adjustable rate mortgage and forego refinancing. Pay attention to our rate sheet, and when deciding which mortgage might be best for you, talk it over with your loan officer who can help you to make the right financial decision.

How much could you potentially save?

As of 4/23/2024, Webster First’s most popular fixed mortgage, the 30 year, has a minimum annual percentage rate (APR) of 7.494%. The most popular adjustable rate mortgage, the 7 & 1 fixed variable, has a minimum APR of 6.796%.

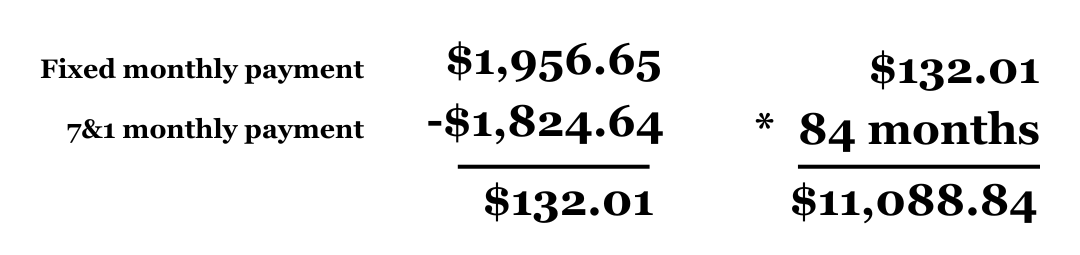

To put into perspective how much you could be saving with an ARM, let’s say you want to buy a home worth $350,000 with a 20% down payment. Our fixed mortgage calculator will show you that your monthly payment will equal approximately $1,956.65 without taxes and insurance. Do those same calculations with our ARM calculator for the 7 & 1 and you get a monthly payment of $1,824.64 for the first 7 years of the loan. In sum, a difference of $132.01 per month for 7 years equals a total of $11,088.84 in savings over that period.

The market is constantly in flux. It’s generally safe to say that if rates are high, they will eventually go back down. At that point it would be smart for anyone, whether in a fixed or ARM, to refinance and take advantage of the lower interest rates. So if you have a mortgage, make sure to keep an eye on interest rates as they change.

*APR = Annual Percentage Rate. Rates accurate as of 4/23/2024. All mortgage APRs are for 1-4 unit owner occupied primary residences based on 20% down payment. APRs may vary with lesser down payment. All mortgages with a loan to value of 80% and over require Private Mortgage Insurance (PMI). Rates subject to change without prior notice. Guidelines available upon request.

Subject to credit union underwriting approval. Taxes and insurance are not included in the payment examples.

The interest rate on ARM loans may increase after the initial fixed rate period following closing.