12 tips to help you spend less on holiday shopping

Updated November 13, 2024 | Published November 16, 2022 by Angela Talbot

-

Categories:

- Saving & Budgeting

- Spending & Shopping

The 2024 holiday shopping season is fast approaching. With consumers’ uncertainty of the impact inflation will have on gift-buying, people are looking to save wherever they can. According to a 2024 Bankrate survey, 1 in 3 holiday shoppers are shortening their wish lists to spend less this year. If you’re shopping on a budget, these tips can help you be frugal without turning into a Scrooge.

Frugal holiday shopping: 12 ways to save money on gifts

1. Start early

You know that holiday shopping comes at the end of every year, so start putting money aside for your holiday gift budget as early as you can. Take a small sum out of your paycheck every week and move it into a savings account. Our All Purpose Account is great for saving toward a specific goal, like holiday shopping. Whether you can afford $50, $25, or even $10 per week, saving over time will take some of the stress out of spending later in the year. If your paycheck is direct deposited, you can have your employer split the money so it automatically deposits your chosen amount to your savings each week.

Make a list (and check it twice) of the people you know you will have to buy for. Write down what they like and start bargain shopping for those items as early as possible. Purchase one item at a time and gradually cross the names off your list.

2. Suggest a Secret Santa or Yankee Swap

If you have a large family and want to shorten your list of people to buy for, suggest a Secret Santa or Yankee Swap (also known as White Elephant, Dirty Santa, or Cutthroat Christmas.) This cuts down your list of people to buy for, which will drastically lower your spending.

3. Chip in on a group gift

So you want to be cheap, but you don’t want your gift to look cheap. Ask around to see if your family or friends are willing to contribute to a more expensive gift for whomever you’d like to treat this holiday. For example, a $100 gift split five ways is only $20 each. This is much more attainable for someone shopping on a budget, and the recipient will get something really nice.

4. Set budget goals

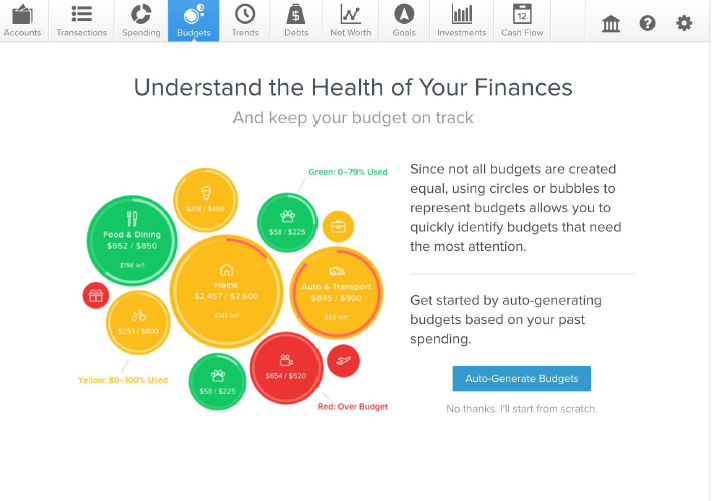

Plan your budget and don’t overspend. Webster First’s online banking offers a budgeting tool – Money Management – to help you set spending limits and monitor your progress. Sort your spending into different categories to allot a certain amount for holiday gifts. You could also limit your spending by withdrawing cash and only using that to purchase your gifts. This allows you to physically see how much you’ve used and how much you have left to spend (it’s easy to go over budget when you swipe your card without seeing your account balance go down.) Keep in mind though, when you use cash you may miss out on certain cash back rewards programs that can be offered through cards and online purchases.

5. Use cash back rewards programs

Opt for a card or program that gives you cash back rewards. Webster First’s debit card rewards program‡ allows you to select the stores you want to shop at and earn cash back when you check out, either in-store or online. Double up on your cash back when shopping online by using browser extensions like Rakuten™*. Rakuten is not a card rewards program, but an application that allows you to activate cash back when you enter the websites of certain stores. It pays out via a “Big Fat Check” at the end of the quarter, and it’s free to use! If you’ll be spending money anyway, why not earn some of it back? Additionally, you can use these programs all year long (groceries, back-to-school shopping, birthdays, etc.) and by the time the holiday shopping season comes around, you could have a nice chunk of money set aside for gifts.

6. Search for deals and coupons

The National Retail Federation’s annual September survey showed 58% of holiday shoppers say that sales and promotions are more important to them when shopping for gifts and other holiday items this year compared to last year. Don’t wait for 12am on Black Friday for deals. In fact, most Black Friday deals aren’t all they’re cracked up to be. In-store mayhem may tempt you to overbuy due to the attractiveness of a sale that isn’t really a great deal at all.

Since the COVID-19 pandemic, retail stores are offering sales much earlier in the season. For the past two years, retailers have been spreading out their Black Friday deals through November and December. Check early and often. Sign up for mailing lists of your favorite stores and pay attention to promotions and coupons they may send you. That being said, make sure you only buy what you need and resist the temptation to buy things just because you have a coupon. A great application to use for coupons when shopping online is Honey™*. Honey is a free browser extension that sifts through coupon codes while you’re at checkout to find one that will yield the highest savings for you.

7. Price-match at the store

If online shopping isn’t your thing, there are many retailers that offer price-matching with competitors or even their own online store. Always shop around for the items that you want to buy to make sure the store you’re buying it from has the absolute best deal. If it doesn’t, try price-matching. The items you are trying to price-match will have to be identical, and be prepared to show proof of the lower price.

8. Take advantage of free shipping day

For the past 14 years, free shipping day has fallen on December 14. If you can’t or don’t want to shop in-store, free shipping on items (especially heavier items) can save you a lot of money. There is a long list of retailers that participate in free shipping day including Target, Walmart, Staples, American Eagle, Best Buy, Bed Bath & Beyond, GameStop, and so many more!

9. Do it yourself

Never underestimate the power of a DIY holiday gift. A homemade gift can be just as meaningful to someone as a store bought one. You could give baked goods or print out a sentimental photo and put it in a frame for a very low cost. If you are hosting and need some decorations to make your place look festive, Pinterest and YouTube are great sources to find Dollar Store DIY craft projects.

If you’re not into making things yourself, dollar stores also have collections of ready-made decorations (and they start stocking them in October!). Also, look in your own home for things you may already have that you could flip into Christmas decor. Try using real pine from your yard. Foraging for your decorations can be a fun family activity!

10. Buy in bulk or have a potluck

This is another tip for those of you that host. If you have a large family and need a lot of food, plates, cutlery, etc. for dinner, buy at wholesale to save yourself some dough. An even better way to save on food would be to have a potluck. Have each person attending your gathering bring one dish. This will also save you lots of cooking time and stress!

11. Turn off your Christmas lights

Leaving your Christmas lights on all night long can rack up a hefty electric bill. National Grid customers in Massachusetts can expect a 3–3.5% increase in their electric bills for the fall of 2024. According to electricchoice.com, the average kWh(kilowatt-hour) rate is 12 cents per kWh. Outdoor string lights using 10,000 watts at 7 hours a night for 45 days = $378.00! Add that with the cost of electricity for your indoor tree and any other plug-in decorations, and you could end up paying an extra $400+ on your monthly bill.

12. Don’t throw out your gift bags

Lastly, when you receive gifts in bags or boxes, don’t throw them out! Save them for use next year. You may even be able to save bows. If you find that you still don’t have enough gift packaging for next year, go to your local stores the day after Christmas when everything is marked down by 50%! Wait even longer, and you could score some wrapping supplies or decorations for 75% off. This brings us back to our very first tip: start your shopping as early as possible!

*Webster First is not affiliated with Rakuten or Honey. These links are being provided as a convenience and for informational purposes only; they do not constitute an endorsement or an approval by Webster First Federal Credit Union of any of the products, services or opinions of the corporation or organization or individual. Webster First Federal Credit Union bears no responsibility for the accuracy, legality or content of the external site or for that of subsequent links. Contact the external site for answers to questions regarding its content.

All trademarks are proprietary to Ebates Inc. ©2024 Ebates Inc. dba Rakuten. All rights reserved.

HONEY Trademark of PAYPAL, INC. © PayPal 2024 All rights reserved.