All the benefits of our free checking account, designed for your business

Looking for a free business checking account with no monthly maintenance fees for your DBA or Trust (using a SSN)? First Advantage Checking for Business offers you all the bells and whistles of our flagship account so you can run your small business the way you want to.

Find a BranchBenefits of First Advantage Checking for Business

$0 Monthly Maintenance Fees

First Advantage Checking for Business has no monthly maintenance fees and no monthly transaction limits.

Convenience after hours

Night depository is available at select Webster First branch locations, enrollment required.

Safety and Security

Your free business debit card comes with complimentary fraud monitoring through our Card Alert Notification Program.

Earn Rewards

Earn cash back42 on qualified purchases with our free rewards program.

Nearly 30,000 ATMs

There is no fee to withdraw funds from Webster First ATMs or ATMs belonging to the SUM or CO-OP Networks.

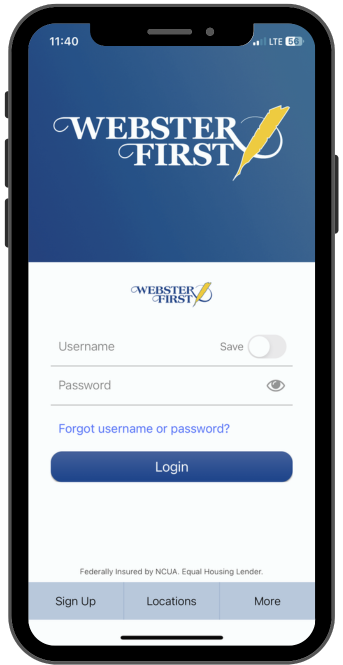

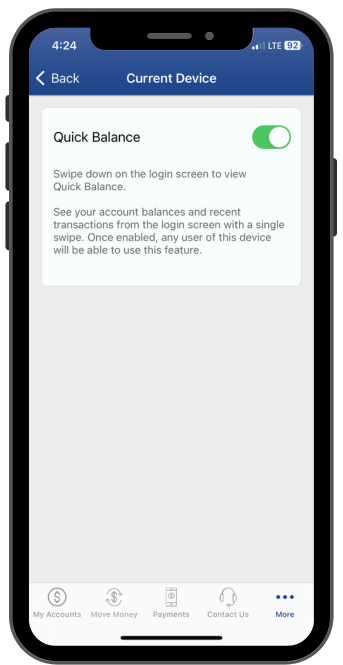

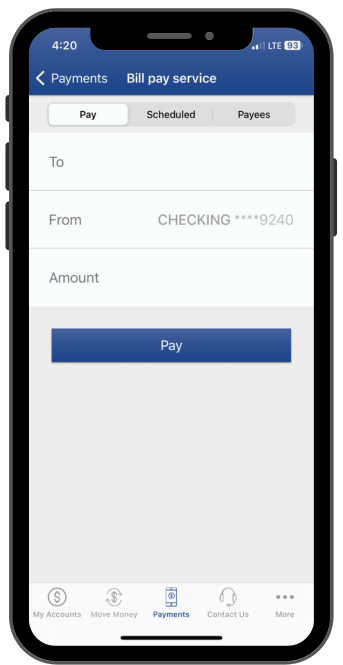

Online & Mobile Banking

Check balances, track budgets, deposit checks, make loan payments, and more.

Convenient access to your business accounts, anytime

Online banking and our mobile app make taking care of business easy.

Learn MoreAward-winning service

Earn rewards and rebates

A great account can be rewarding in more ways than one.

Earn cash back42 on qualified purchases with our free program:

- Shop offers right from online banking or our app.

- Shop based on the offer terms using your Webster First Mastercard® debit card or connected mobile wallet.

- Earn your cash reward! Rewards are deposited right into your account.

Plus, you can earn rebates with the Mastercard Easy Savings® program30.

FAQs

What are the requirements to open?

- Business must be a DBA or Trust using a SSN

- One of the following must apply:

- Business owner is a current Webster First member

- Business owner lives, works, worships, or attends school in Essex, Middlesex, Suffolk, or Worcester County of Massachusetts

- Business is located in Essex, Middlesex, Suffolk, or Worcester County of Massachusetts

- $5 minimum balance

What documents will I need?

- Driver’s License

- Social Security number

- DBAs must also provide:

- Business certificate from the town the business is located in

Apply for your business checking account today

Visit your local branch to open a First Advantage Checking for Business account. $5 minimum opening balance.