New year’s budgeting made easy

Updated March 22, 2024 | Published January 27, 2022 by Angela Talbot

-

Categories:

- Saving & Budgeting

Money Management, available for free in online banking and our mobile app, makes budgeting easier than ever. So if one of your New Year’s resolutions was to get your finances in order, read on for a step-by-step walkthrough on how to set up a budget using Money Management.

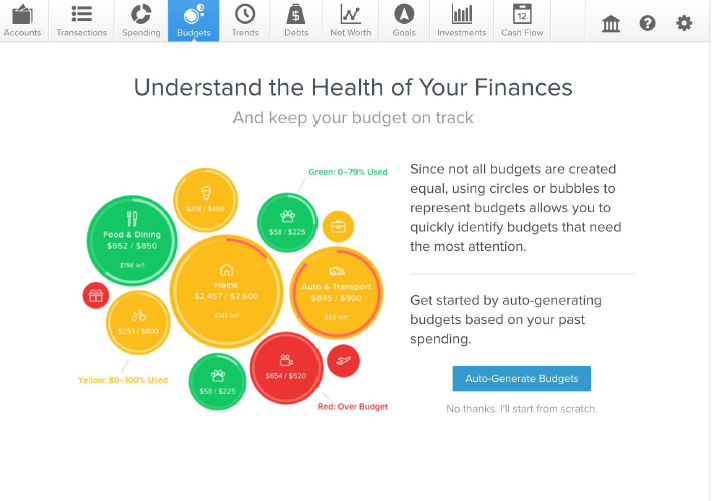

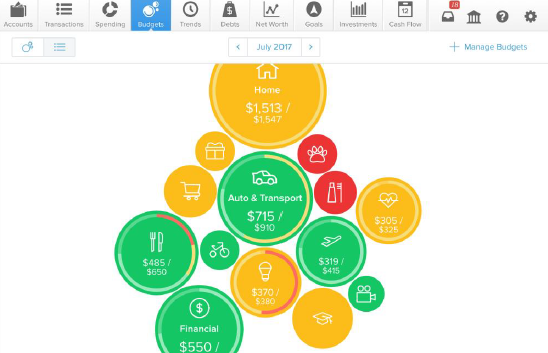

Budgeting can help you set realistic monthly spending limits and monitor your progress. The Budgets tab helps to identify categories that need your attention the most — big bubbles represent a larger portion of your monthly budget, and red bubbles have exceeded their monthly allowance.

Auto-generate budgets

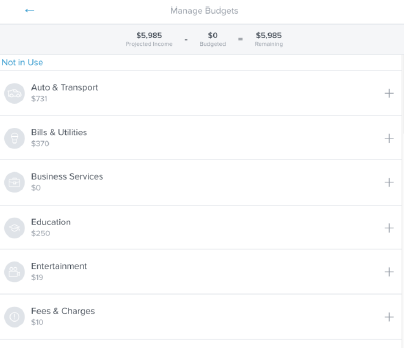

When you first use Budgets, you have the option to auto-generate budgets or to start from scratch. We encourage you to first use the auto-generate budgets feature, which will create a starting budget for you based on your average spending in each category over the previous 90 days. This budget calculation will be more helpful if you have added all your accounts first. Your Webster First accounts will automatically show within Money Management, while you can manually add accounts from outside institutions.

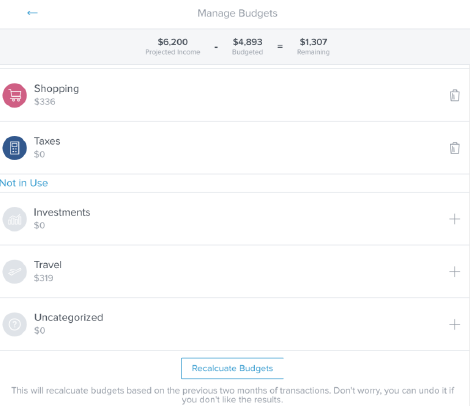

Once the auto-generate is finished, review your budget and adjust anything if necessary. You can decide which categories you want included. If a category was added during auto-generation that you do not want in your budget, you can delete it by clicking on the trash can icon to the right of the screen.

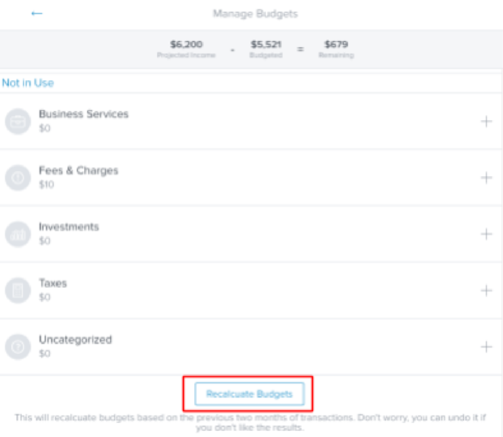

You can recalculate your budgets any time. Recalculated budgets are based on the last 90 days of transactions to better tailor your budget to your actual spending.

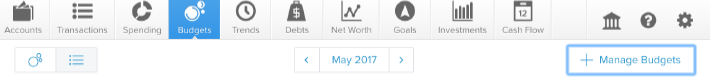

- Click on the “Manage Budgets” link on the top right of the budgets home page.

- Scroll to the bottom of the pop-out menu.

- Click on “Recalculate Budgets”.

Budgeting from scratch

If you choose to start from scratch, the software will present a list of spending categories. Select a category to set its budget.

Budgeting with bubbles

You’ll see bubble budgets by default, but you can switch to a list view if you prefer. Click on the small list or bubbles icons, depicted below, to toggle between the views.

![]()

The benefit of bubble budgets is that they allow you to see both the health and the impact of your budget categories, pulling your attention toward areas that need it most. The color of your bubbles indicates whether you are on track, nearing your budget limit, or over limit:

- Green: below 80%

- Yellow: between 80-100%

- Red: over 100%

The size of your bubble represents the budget amount, relative to your overall budget. The larger the bubble, the more of your overall budget that category consumes. The bubble will grow to reflect the percentage the category represents.

To edit a budget amount, click on a bubble to display the budget details window. Here, you can click the pencil icon to edit or delete the selected category, view spending trends in that category and add sub-budgets. Note that if you increase your sub-budgets to an amount greater than the parent budget, the parent budget amount will also increase. Deleting or decreasing a sub-budget will not affect the parent budget.

Click on a sub-budget to reveal details for that sub-budget. Here, you can edit or delete that sub-budget, view spending trends in that sub-budget or click the bubble to view related transactions.

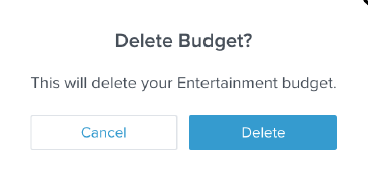

To delete a budget:

- Click on the budget bubble to open the detail view.

- Click on the pencil icon.

- Click “Delete [budget name]”.

- Click “Delete” again to confirm.

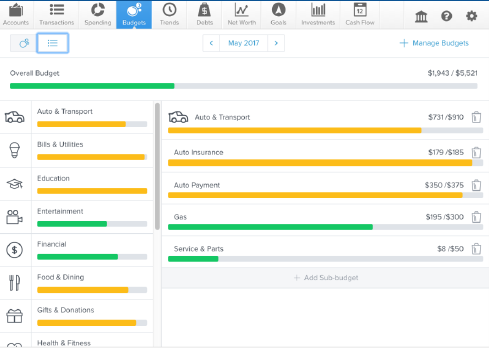

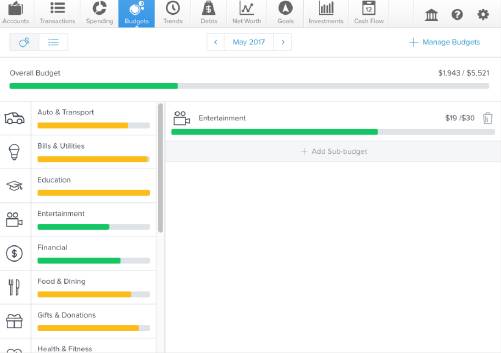

List view

The list view allows you to see a detailed list of categories and subcategories. Here, you can quickly make budget edits without the need to navigate in and out of the budget details window.

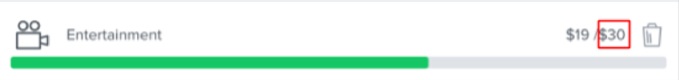

The colored bars represent the status of your budget:

- Green: below 80%

- Yellow: between 80-100%

- Red: over 100%

Budget amounts can be edited from the left side of the screen, which shows a list of categories and corresponding budgets. Clicking a budget displays a list of child budgets, along with the amount you’ve used.

Click a budget to make changes. Click the budget amount to increase or decrease it.

To delete a budget, click the trash can icon. After you click on the trash can, click “Delete” in the pop-up screen.

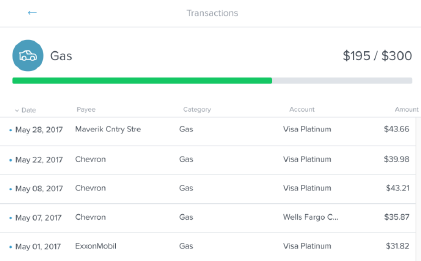

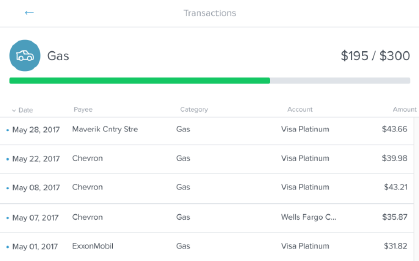

View budget transactions

Click on any budget to see a list of all transactions within the related category. You can access transaction details and re-categorize transactions here, just like in the Transactions tab.

Manage budgets

Use the “Manage Budgets” button to quickly add, remove, or recalculate budget categories.

To add a budget category:

- Click on “Manage Budgets” in the top right corner.

- Scroll to the bottom of the pop-out menu to see categories labeled “Not in Use”.

- Choose the category that you would like to add.

- Click on the category and adjust the budgeted amount.

To delete a budget category:

- Click on “Manage Budgets” in the top right corner.

- On the category you want to delete, click on the trash can to the right.

- Click “Delete” to confirm.